ARDCI Microfinance Insurance Program pay P144-M in claims to beneficiaries

On the other hand, ARDCI’s Loan Protect Plus (LPP) not only helps the member’s family in case of his sickness but also addresses risks associated with illness. It pays P100 to P500 for each day of confinement in a registered hospital, which would help the member pay his obligation.

A Medicine Allowance ranging from P100 to P500, depending on the confinement period, Is also given to the insured borrower during confinement, with only the proof of confinement required. No receipts are required for the benefit, which is in addition to the amount of other insurance payable under the policy.

Even if a fire or natural calamities befall the insured member and his house is totally damaged, he or she will receive a Special Financial Assistance (SFA) of P5,000.00. Among other conditions, however, the lot where the destroyed house is built must be owned by the members and the house itself must be his or her declared residence.

Members are automatically qualified for the benefit regardless of his membership date and they do not have to make any insurance contribution since it is already covered by the Basic Benefits Package.

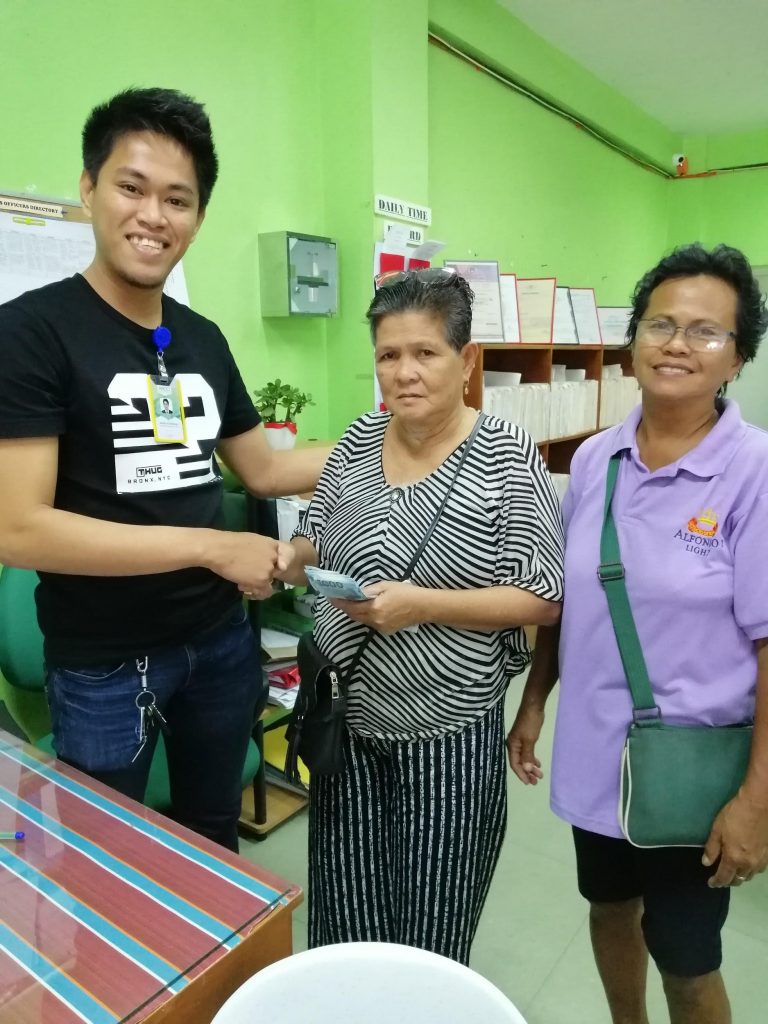

In LUCENA CITY, another ARDCI member receives her insurance benefits soon after submitting needed documents to the branch office.

Subject to limitations, the Group Accident Medical Reimbursement (GAMERR) reimburses the actual medical expenses incurred during the treatment of accident-related injuries at a maximum of P15,000 for the member, P5,000 for the spouse and P1,000 for the child dependent, with the last two required to have more than three years of membership.

For those getting on in years, ARDCI Microfinance’s insurance program automatically entitles any member who reaches the age of 75 years old the Exit Age Benefit of P10,000, with his spouse or parent dependents also given P5,000 of the same benefit when they turn 75.

Not only does the program make it easy for the members or their dependents to claim, due to the minimal number of requirements, any bonafide member of ARDCI Microfinance who is actively at work and in good health, but at least 18 to 65 years old upon enrolment are also qualified for the Group Comprehensive Benefit. The Group Credit Life, on the other hand, covers any borrower who is of the same qualifications but only the principal borrower is insured and no substitution is allowed.

The insured has the right to designate anybody not disqualified by law to be his beneficiary or beneficiaries. But if there will be no designated beneficiary or beneficiaries surviving upon his death, the benefit is given to surviving kin.

Depending upon the years of membership, a principal member is eligible for insurance ranging from P10,000 to P100,000 while his spouse/parent will be insured for P15,000 to P50,000, the child from P3,000 to P10,000.

Truly, ARDCI Microfinance’s pitch for its insurance program – “It’s not for you; it’s for those you care most about” – has resonated well in the hearts of its members and borrowers in the island if its birth and across the country.